Dollars in the Digital Realm: Navigating Online trading Platforms

Online trading has revolutionized the way we invest and trade in the financial markets. In the past, investors had to call their brokers to place orders, which was both time-consuming and expensive. But with the advent of online trading platforms, individuals can now trade securities, currencies, and commodities in real-time from the comfort of their homes or offices. However, online trading can also be confusing, intimidating, and risky, especially for beginners. This blog post will provide a basic guide for navigating the digital frontier of online trading.

1. Understanding the Basics

Before you start trading online, it’s essential to understand the basic concepts of trading. You need to know how the financial markets work, how to read charts and graphs, and how to interpret economic news and data. You should also have a basic understanding of trading instruments such as stocks, bonds, currencies, and commodities. You can learn these concepts through online courses, books, or trading simulators. Once you have a firm grasp of the basics, you’ll be ready to start trading.

2. Choosing a Broker

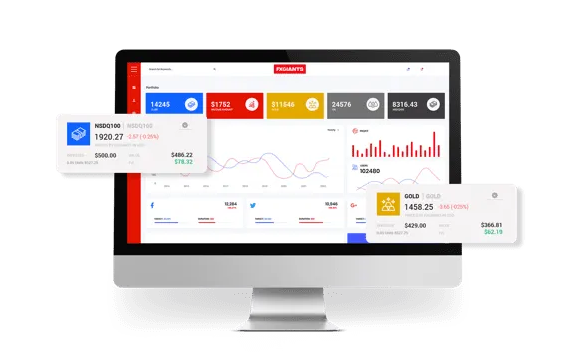

The next step is to choose an online trading platform or broker. There are many options to choose from, and each one offers different features, fees, and user interfaces. You need to choose a reputable broker that meets your trading needs and fits your trading style. Some brokers offer low fees and commissions but may have limited research and educational resources. Others may charge higher fees but provide better customer support and trading tools. Do your research and choose the right broker for you.

3. Mastering the Platform

Once you’ve chosen a broker, it’s time to master the platform. You should take advantage of the educational resources and tutorials provided by the broker to learn how to use the platform. You should also practice trading with a demo account to get comfortable with the platform and test your trading strategies. When you’re ready to start trading with real money, start small and gradually increase your position size as you gain confidence.

4. Managing Risks

Online trading can be risky, and you need to manage your risks effectively. You should never invest more than you can afford to lose, and you should always have a trading plan with predefined entry and exit points. You should also diversify your portfolio by investing in different assets and not putting all your eggs in one basket. Additionally, you should use risk management tools such as stop-loss orders, which automatically close your trade if it reaches a certain loss level.

5. Continuous Learning

Finally, online trading is constantly evolving, and you need to keep learning to stay ahead of the curve. You should stay up-to-date with the latest market news, trends, and events. You should also continuously improve your trading skills through online courses, books, and trading communities. Never stop learning and adapting to the changing market conditions.

Conclusion:

Online trading can be lucrative, exciting, and challenging, but it requires knowledge, discipline, and a solid trading plan. By understanding the basics, choosing the right broker, mastering the platform, managing risks, and continuously learning, you can navigate the digital frontier of online trading with confidence and success. Remember that trading is not a get-rich-quick scheme, and it requires patience, persistence, and hard work. Good luck and happy trading!